idaho vehicle sales tax calculator

Learn about Idaho tax rates for income property sales tax and more to estimate your 2021 taxes. Calculating Sales Tax Summary.

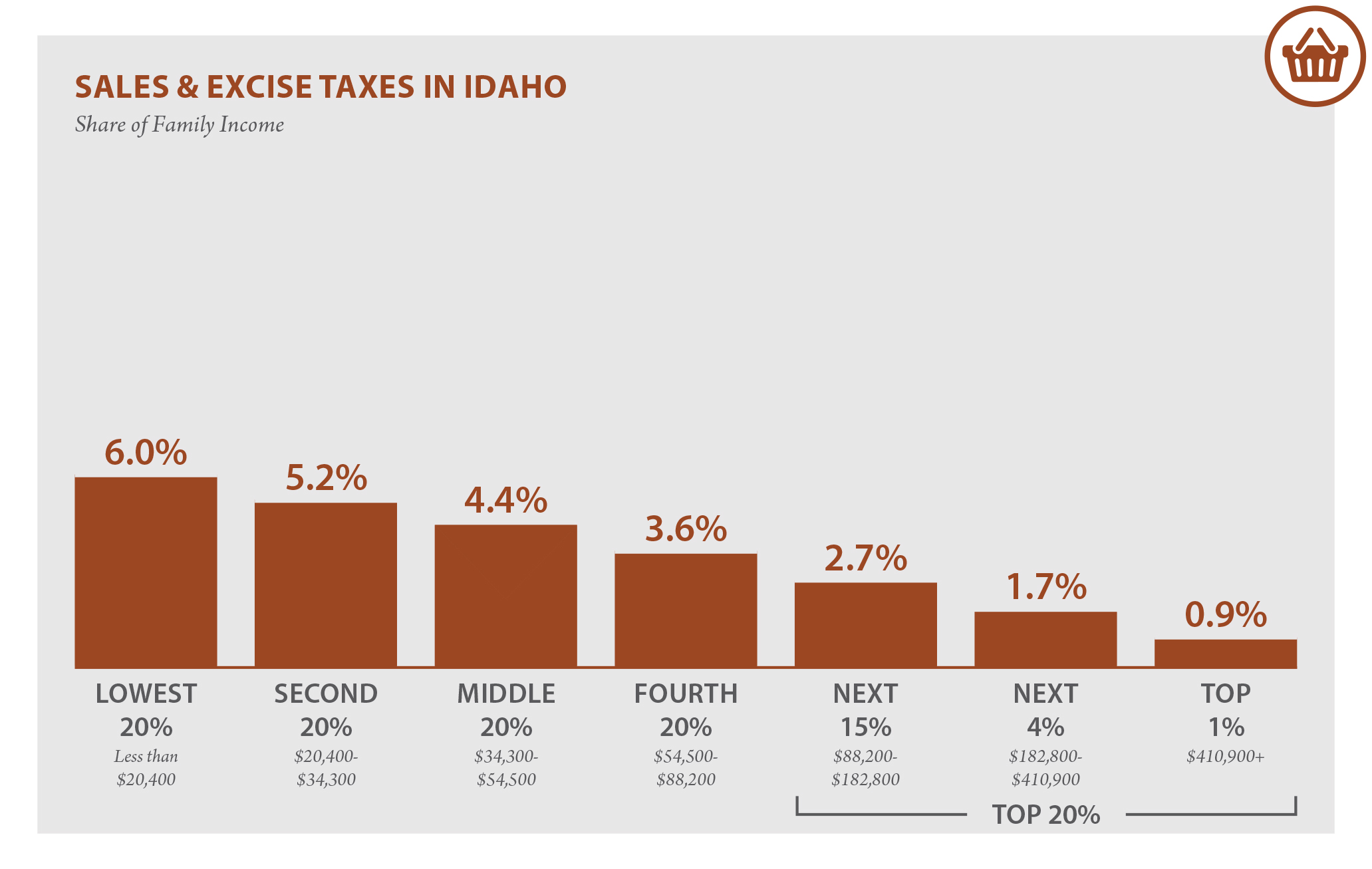

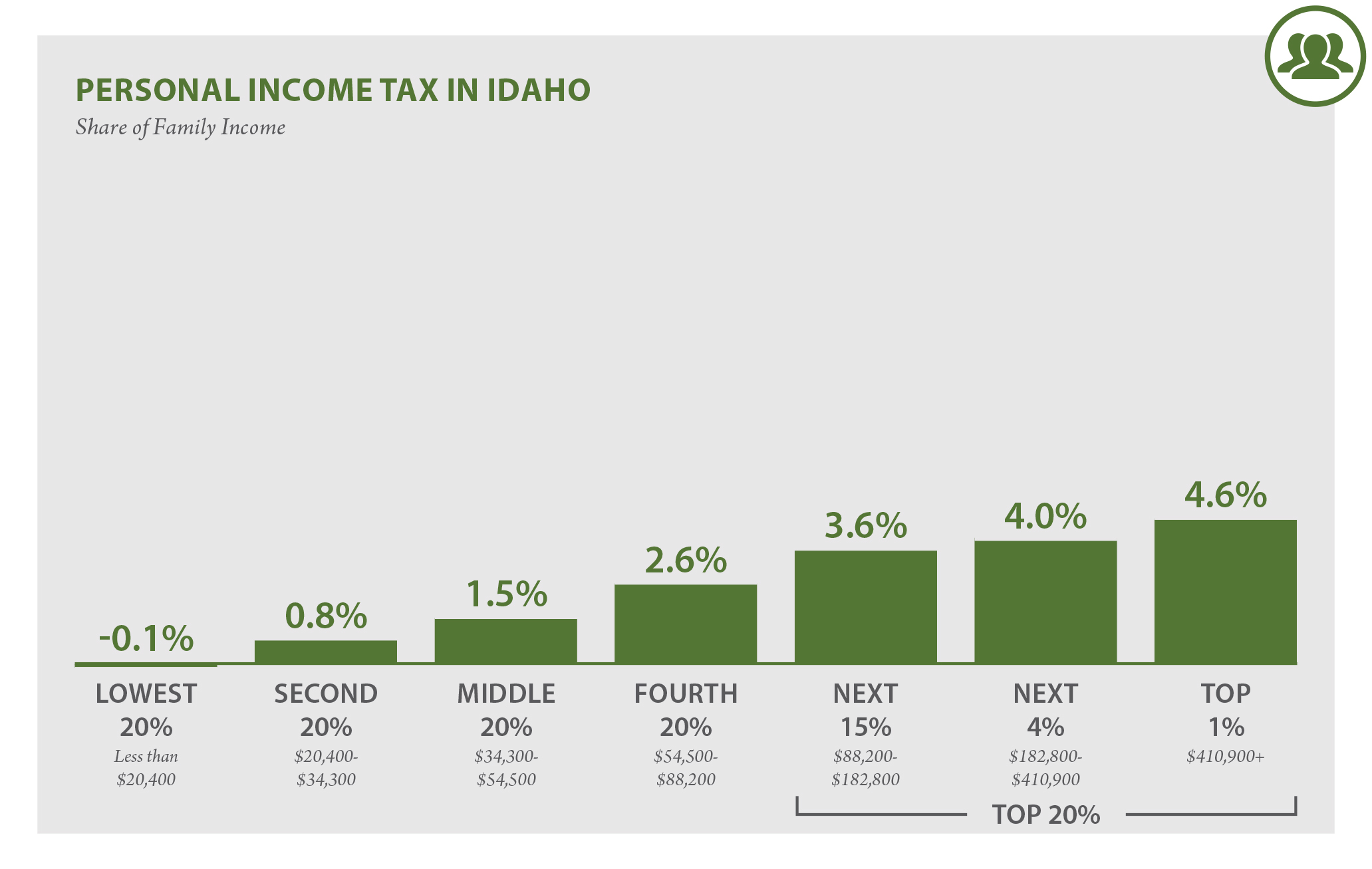

Idaho Who Pays 6th Edition Itep

In addition to taxes car purchases in.

. How to Calculate Idaho Sales Tax on a Car. The most populous zip code in. Ad Lookup Sales Tax Rates For Free.

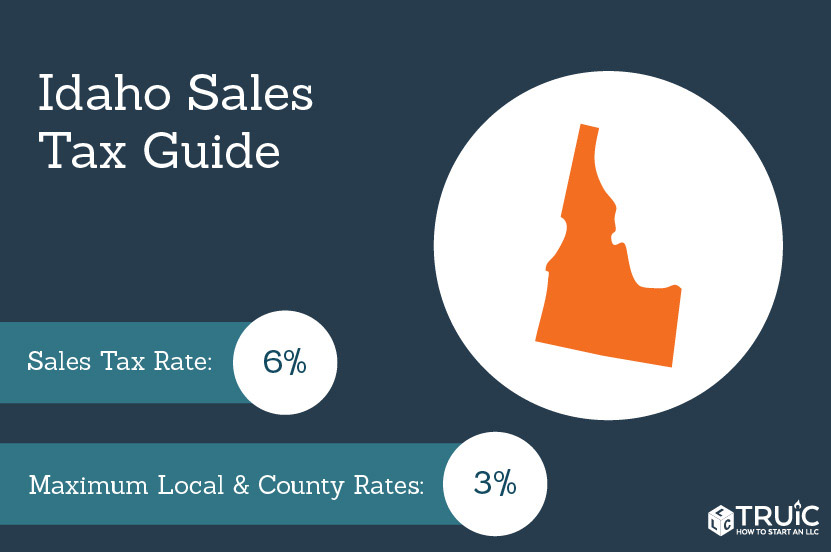

Iowa state income tax rates range from 0 to 853. Its easy to calculate the state sales tax on your vehicle purchase in Idaho. So whilst the Sales Tax Rate in Idaho is 6 you can actually pay anywhere between 6 and 9 depending on the local sales tax rate applied in the municipality.

Take your original purchase price deduct any trade-in. Interactive Tax Map Unlimited Use. How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio States With Highest.

Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. Idaho has a 6 statewide sales tax rate but also has. Free calculator to find the sales tax amountrate before tax price and after-tax price.

How to Calculate Idaho Sales Tax on a Car. How much is sales tax in Eagle in Idaho. While tax rates vary by location the auto sales tax rate typically ranges anywhere from two to six percent.

As far as other cities towns and locations go the place with the highest sales tax rate is Riggins and the place with the lowest sales tax rate is Cottonwood. Our free online Idaho sales tax calculator calculates exact sales tax by state county city or ZIP code. In our area here in the Boise area sales tax is six percent but if we sell to an Oregon resident they dont have to pay Idaho sales tax.

Calculating Sales Tax Summary. What happened to tanimura after yakuza 4 august 6 2006 moon phase. And special taxation districts.

You can always use Sales Tax. Your household income location filing status and number of personal. Idaho collects a 6 state sales tax rate on the purchase of all vehicles.

6 is the lowest possible tax rate Pocatello Idaho7 8 85 is all other possible sales tax rates of Idaho. Multiply the net price of your vehicle by the sales tax percentage. 635 for vehicle 50k or less.

775 for vehicle over. Idaho sales tax calculator. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

You can view your local Idaho sales tax rates using TaxJars sales tax calculator. Learn about Iowa rates for income property sales taxes and more to estimate what you will pay. Car Tax By State Usa Manual Car Sales Tax Calculator Paid directly to the dealer and.

The sales tax rate for Eagle was updated for the 2020 tax year this is the current sales tax rate we are using. This guide is for individuals leasing. With local taxes the total sales tax rate is between 6000 and 8500.

The amount allowed on the traded-in merchandise reduces the sales price which is the. Sales tax in Eagle Idaho is currently 6. Sales Tax Rate s c l sr.

You can accept merchandise as full or partial payment of a motor vehicle you sell. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. Ad Lookup Sales Tax Rates For Free.

A sales tax is a consumption tax paid to a government on the sale of certain goods and. In virtually every state that Ive seen that operates this way. Interactive Tax Map Unlimited Use.

Idaho state income tax rates range from 0 to 65. Our calculator has recently been updated to include both the latest Federal Tax Rates. For example imagine you are purchasing.

With local taxes the total sales tax rate is between 6000 and. For vehicles that are being rented or leased see see taxation of leases and rentals. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

The state sales tax rate in Idaho is 6000. Sales or use tax is due on the sale lease rental transfer donation or use of a motor vehicle in Idaho unless a valid exemption applies. Its easy to calculate the state sales tax on your vehicle.

Idaho vehicle sales tax calculator Thursday March 17 2022 Edit. Some states provide official vehicle registration fee. You are able to use our Idaho State Tax Calculator to calculate your total tax costs in the tax year 202122.

How to Calculate Idaho Sales Tax on a Car.

Idaho Sales Tax Small Business Guide Truic

Idaho Who Pays 6th Edition Itep

Dmv Idaho Transportation Department

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Dmv Idaho Transportation Department

Dmv Fees By State Usa Manual Car Registration Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

States With Highest And Lowest Sales Tax Rates

Dmv Idaho Transportation Department

Dmv Idaho Transportation Department

Idaho Sales Tax Guide And Calculator 2022 Taxjar

How Is Tax Liability Calculated Common Tax Questions Answered

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Taxes In The United States Wikiwand

How Do I Avoid Paying Sales Tax On A Car In Idaho 2022

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation