japan corporate tax rate 2020

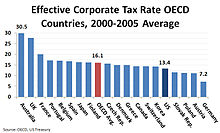

The Corporate Tax Rate in Japan stands at 3062 percent. Corporate Tax Rate in Japan averaged 4083 percent from.

Corporate Income Tax Rates For Selected Countries Photo Credit The Download Scientific Diagram

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

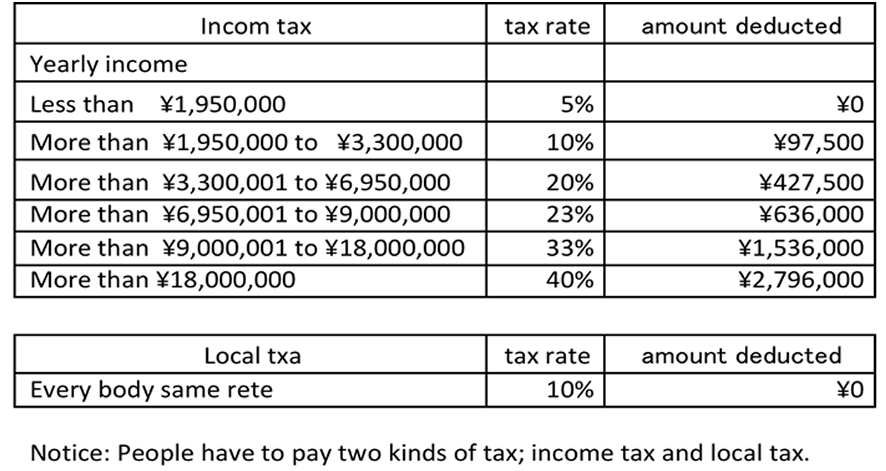

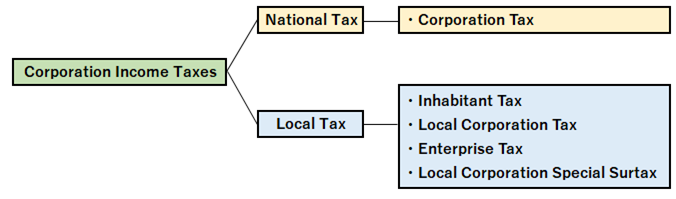

. Corporate Tax Rate in Japan averaged 4083 percent from. Corporate Tax Rates 2022 includes information on statutory national and local corporate income tax rates applicable to companies and branches as well. 332 Corporate income taxes and tax rates.

A corporate tax is a total tax applied to the profits of a. 96 rows Exempted when paid by a company of Japan holding at least 15 direct or indirect or 25 direct shares for six months. Corporate Tax Rates 2022.

Corporate Tax Rate in Japan averaged 4119 percent from 1993 until 2020 reaching an all time high. Reduced corporate tax rate preferable allowable ratios. Data published Yearly by National Tax.

Global tax rates 2017 is part of. 96 67 96 70 Local corporate special tax or special corporate business tax the rate is multiplied by the income. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching.

Japan also slowly decreased its corporate tax rate from 42 in 2003 to 3062 in 2019. 5 for holding at least 10. The maximum rate was 524 and minimum was 3062.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. A group company that would otherwise qualify as an SME on a stand-alone basis is not eligible for SME benefits eg. Global tax rates 2017 provides corporate income tax historic corporate income tax and domestic withholding tax rates for more than 170 countries.

Corporate Tax Rate in Japan remained unchanged at 3062 in 2022. Beginning in 1983 incorporated professional practices personal service corporations have been taxed on all taxable income at the corporate tax rate applicable to. 2021 2020 2019 2018 2017.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Tax rates The tax rates applied to profit and loss sharing groups will be the respective tax rates applied to each individual entity in accordance with its corporate. Corporate tax rates table - KPMG Global - KPMG InternationalKPMGs corporate tax table provides a view of corporate tax rates around the world.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. 73 51 73 53 Over JPY 8 million. The taxes levied in Japan on income generated by the activities of a corporation include corporate tax national tax local.

What Is a Corporate Tax. The average tax rate among the 223 jurisdictions is 2257 percent.

China Corporate Tax Rate 2022 Data 2023 Forecast 1997 2021 Historical Chart

Corporate Tax In The United States Wikipedia

Yellen S Global Tax Plan Is On The Level Of Trump S Trade War With China Bloomberg

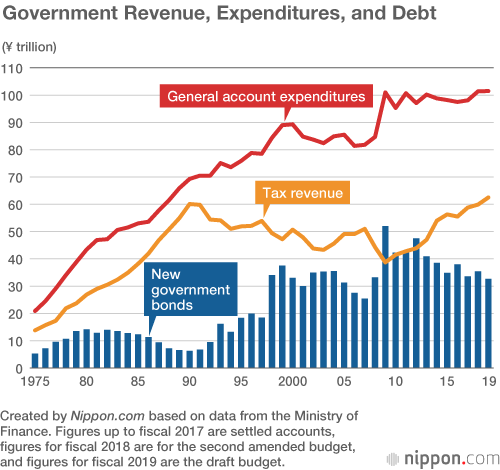

Japan Tax Income Taxes In Japan Tax Foundation

Japan S Consumption Tax Increase Not Enough To Keep Up With Swelling Budget Nippon Com

Stagnant For Decades Japan Needs Supply Side Tax Cuts Cato Institute

Dentons Global Tax Guide To Doing Business In Ecuador

G20 Corporation Tax Rates As Of 1st April 2015 Download Scientific Diagram

:max_bytes(150000):strip_icc()/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-02-2d1d9e3a2450426893a7cb627c44baf9.jpg)

Countries With The Highest And Lowest Corporate Tax Rates

Corporate Tax Rate In Japan Ventureinq Accounting Firm In Japan Tokyo

Economic Survey Of Japan 2008 Reforming The Tax System To Promote Fiscal Sustainability And Economic Growth Oecd

George Eaton On Twitter The Race To The Bottom Has Finally Been Halted After 40 Years Minimum Global Corporate Tax Rate Of At Least 15 Has Now Been Agreed By G7

Corporate Income Tax Return Filing In Japan Latest 2021 2022 Shimada Associates

Japan Clears Way For Corporate Tax Cut Wsj

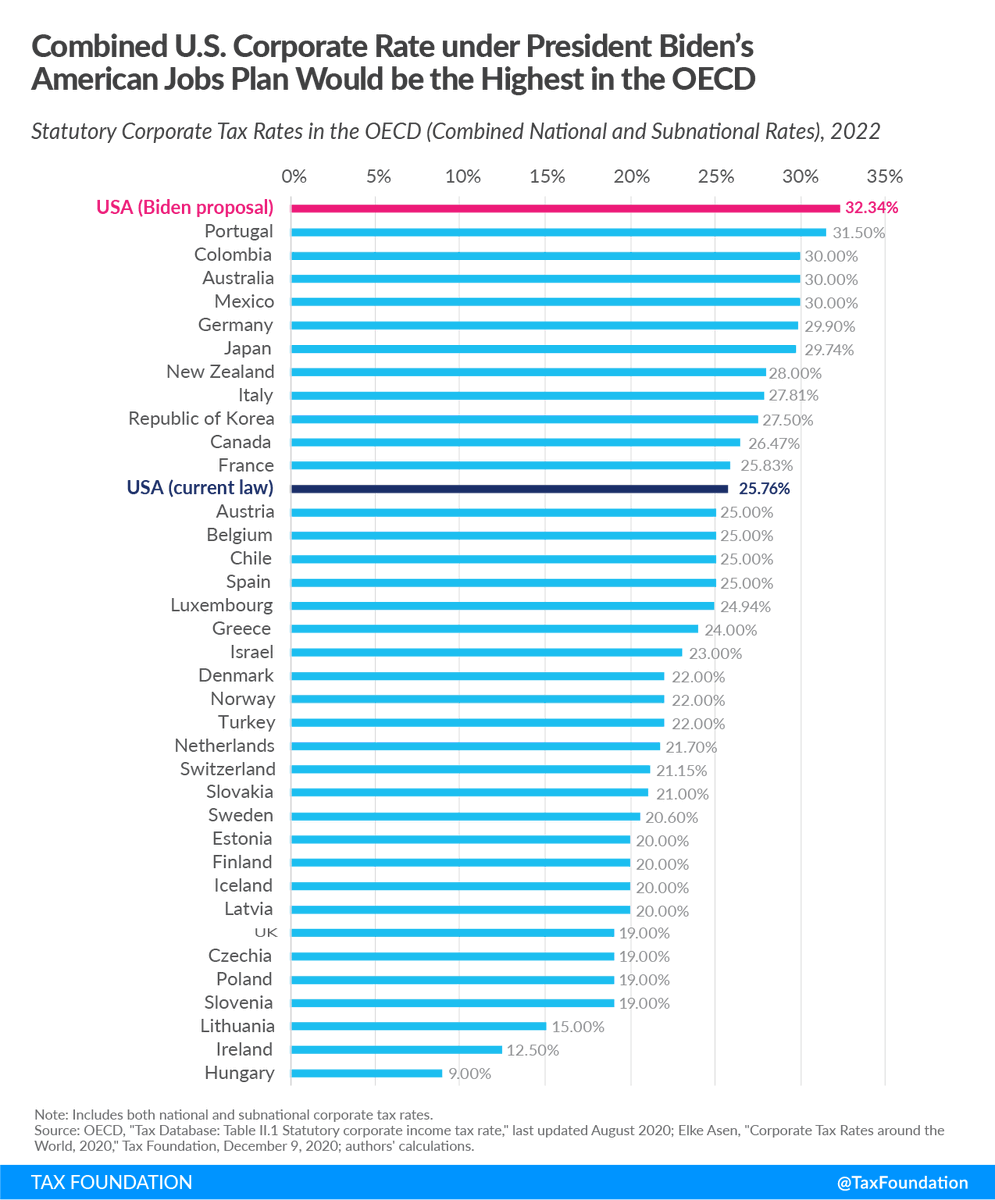

Tax Foundation On Twitter Raising Corporate Income Taxes Would Put The U S At A Competitive Disadvantage Whether One Looks At Statutory Tax Rates Or Effective Corporate Tax Rates Https T Co N82cs9xtbo Https T Co Jdxd1nbdxm Twitter

Tax Foundation President Biden S Proposal To Increase The Corporate Tax Rate And To Tax Long Term Capital Gains And Qualified Dividends At Ordinary Income Tax Rates Would Increase The Top Integrated Tax